Monday, 7 December 2015

Friday, 4 December 2015

Monday, 30 November 2015

Thursday, 26 November 2015

Tuesday, 24 November 2015

24.11.2015 Tuesday

CHART SHOWING ACTUAL TRADES

CHART SHOWING IDLE TRADES

(HINDSIGHT VIEW)

Today also, i was trying to control my greed to enter into trade when i see a channel after break. You can see my greed on chart, in all trades, i have entered on the same candle on which i have exited.

It is quite difficult to follow the simple rules but if you could able to follow them, it can convert the situation upside down.

Monday, 23 November 2015

23.11.2015 Monday

CHART SHOWING ACTUAL TRADES

CHART SHOWING IDLE TRADES

(HINDSIGHT VIEW)

As usual another day of over trading or desperation trading and ended the day is loss. Initially first trade taken was excellent trade. Thereafter took three trades simultaneously which was disastrous.

Trying my level best to control this emotion but failing again and again. Will try another day to be in control to avoid this type of situation.

Thursday, 19 November 2015

Closing The Gaps

There was an wonderful post by ST sir titled "Closing the Gap". From today onwards, i will be posting two charts.

Please read the full post on ST sir blog. Link to the Post.http://niftynirvana.blogspot.in/2012/04/close-gap.html

No. 1 Chart will be showing the actual trades taken by me

No 2 chart will show the view in hindsight

This exercise will allow me to compare my actual performance to the idle performance and will enable me to correct on my deficiencies and help me in closing the Gaps.

Please read the full post on ST sir blog. Link to the Post.http://niftynirvana.blogspot.in/2012/04/close-gap.html

No. 1 Chart will be showing the actual trades taken by me

No 2 chart will show the view in hindsight

This exercise will allow me to compare my actual performance to the idle performance and will enable me to correct on my deficiencies and help me in closing the Gaps.

Monday, 16 November 2015

Quite Inspiring !

Inspirational Thought

Thought i should upload this video as i find it very much inspiring for myself.

Lesson Learnt: Enlighten yourself first then only you can enlighten the world.

Now a days i am fighting with the life threatening disease that is called Over Trading/Revenge Trading. I decided not to post till the time i recover from this grave situation.

Thought i should upload this video as i find it very much inspiring for myself.

Lesson Learnt: Enlighten yourself first then only you can enlighten the world.

Now a days i am fighting with the life threatening disease that is called Over Trading/Revenge Trading. I decided not to post till the time i recover from this grave situation.

Wednesday, 4 November 2015

04.11.2015 Wednesday

Prices opened full gap up above the PDH and were unable to sustain above previous day high. Wanted to enter short on the marked location in above chart but unable to do that view I was busy in setting up software and trading module of newly joined broker. I exited the previous broker due to high brokerage only otherwise quality and services provided by them were excellent.

Prices found very choppy and did not found any good trade setup today. At 10:54 Prices Tested the BRN-8100 level and bounced back to the previous day’s range high. After testing the previous day range high, prices started falling down. Expected a BOF on re-test of the BRN level or BO of the BRN. A minor trend line was forming from previous day’s last two swing lows. Noticed that price momentum was slowing down considerably when prices approaching the Trend line and BRN. Went Long on the first green candle which gives me an indication that Bulls have come in.

Prices have broken out in the next candle and went up to test the previous day’s range high and after trading in a range at the previous day’s range high, prices have fallen down to test the trend line. After testing the trend line support prices again bounced back to previous day’s range high. When prices moved up to test the previous day’s range high second time, moved my SL to feasible possible position so that if prices again reverse sharply from this level then I should exit at least some profit. The same thing happened and exited by booking a small profit.

Tuesday, 3 November 2015

03.11.2015 Tuesday

Entered Long on Direct BO of Opening Candle Range High. Exited on Breakeven when prices failed to Go Up in second attempt.

Second Entry was short on Below the Low Line of Symmetrical Triangle made after the BO of BRN. Also exited on Breakeven when prices failed to go below the Low of BO Bar in second attempt.

Did not attempt any other opportunity after that due to low volumes traded on Nifty and Money Management Rule.

Monday, 2 November 2015

02.11.2015 Monday

Today I

did not trade. The below commentary is the view in hindsight only with my

limited knowledge and experience.

Market

opened within previous day’s range below the PDC. Attempted to test the PDC

level and failed. Prices has broken the PDL and found resistance at RN-8050. A

BO pull back happen of PDL as marked location A. BOF happen on pull back of

last BO level triggered an short entry

as it also complies our zone theory rule and also the current bias rule . The

position will be scratched when BO of RN failed and formed a hammer candle as

it shows that buyers are stopping the prices to go below this level and some

big money is buying there which is stopping the downfall. Prices went up and

FTC at PDL at point C. Prices came back to RN after FTC at point C. Prices

found resistance to go below RN as we can see overlapping candles near RN.

Finally BO of RN happened where buyers have given up their buying. After BO

prices pull back to test the low of last BO hammer candle of RN and FTC. A

short entry triggered at point D as it also complies to our zone theory and

current bias rule. The downward movement of prices are stopped out at 8031 and

prices moved within the range of the candle made at 11:33. This candle becomes

the master candle. First attempt to BO the low of master candle happened at

point E. Exited the position when prices had failed to go below the low of

master candle second time. Prices have gone up to test the RN which is the last

BO level and FTC. Avoided the entry as prices have refused to go below the day

low three times earlier. Prices approached to day low level and a BOF of day

low triggered the long entry. Will avoid to take this entry as it is a counter

trend entry and the FTA is very close to it and also it does not comply the

zone theory.

Friday, 30 October 2015

30.10.2015

Entry 1 - Joined at 10:24, but identified the Entry 1 at 10:30 when prices Bounced again from IRH after PB. Did Not Enter at the PB because I was not much confident as Next FTA was near. Thought that exact low risk entry was at PB of PDC only. Entry Avoided.

Entry 2 - Went Long when Prices has given a TST-FTC signal of IRH and Prices found support at Minor Up Trend Line. Had to scratch the traded when prices comes down due to micro SL Management.

Entry 3 - Short at Entry 3 for the following reasons:

1. Prices had broken the Minor Up Trendline

2. Very fast and wide rejection of last attempt to test the previous swing high shows bears had taken the control

3. Prices had failed to take support at IRH third time.

Trailed the position with Swing Points and covered as marked.

Wednesday, 28 October 2015

28.10.2015

1. Went Long - Thought Process - Prices were Holding on Day Open (8204) and earlier at 11:27

and 11:25, Two BO attempts to break Lower Range got failed. SL was below the Pin Bar made at 11:27 which got hit

as marked by Blue Line.

and 11:25, Two BO attempts to break Lower Range got failed. SL was below the Pin Bar made at 11:27 which got hit

as marked by Blue Line.

2. Went Short - Thought Process - Prices BO at Lower Range and sustained in the area.

Kept SL above the BO Bar. Covered the Position as marked by Blue Line

Kept SL above the BO Bar. Covered the Position as marked by Blue Line

3. Again Went Long - Thought Process - Last Leg was Bullish and it seems that Bulls have taken the control. SL Hit as marked by Blue Line

4. Went Short - BO of Range Low. Covered the Position as Marked by Blue Line

Result of The Day - The Day Closed with a small Loss and moreover i made my Broker Happy.

Mistakes -

1. Ignored the Rule of Master Candle as in both Long Positions earlier i decided to on the following conditions:

- At No. 1 Long Position, i first decided to went long only once the prices closed above line marked as NS BRN as it is high of the BO candle also

but went Long when see that prices are holding at Day Open.

2. At Second Long Position Also earlier i decided to go long only once the prices closed above the last swing High candle made at 13:33, but wnet long in Hurry.

- At No. 1 Long Position, i first decided to went long only once the prices closed above line marked as NS BRN as it is high of the BO candle also

but went Long when see that prices are holding at Day Open.

2. At Second Long Position Also earlier i decided to go long only once the prices closed above the last swing High candle made at 13:33, but wnet long in Hurry.

3. At the starting of day i was in view that prices had opened below the PDC and prices are in the Sell Zone and i will only look for the Short Opportunities

but meanwhile i forced my self to take Counter Trend Positions and Ignored the Current Bias

but meanwhile i forced my self to take Counter Trend Positions and Ignored the Current Bias

Monday, 12 October 2015

How to Learn Day Trading

Replica from Nifty Nirvana. Thanks for the Guidance.

http://niftynirvana.blogspot.in/2012/02/how-to-learn-day-trading.html#comment-form

How to Learn Day Trading

http://niftynirvana.blogspot.in/2012/02/how-to-learn-day-trading.html#comment-form

How to Learn Day Trading

If you are ready to take a little effort, you can learn it really fast.

I assume you have some basic knowledge.

First thing you have to do is selecting your time frame. If you cant stand the Formula 1 speed of 1M chart select 3M or 5M.

Now decide how many points of Nifty you need to capture. If it is 10 add another 5 points for commission and slippage. So you may need minimum 15 point move.

Next step is to open your historical chart. Mark all the 15 points or above moves on this chart. Note down or better mark on the chart the following

1. Location from where the move started ( HOD, LOD. PDH etc.}

2. Location where the move ended

3. Locations where the move paused

4. Notice and note down the pattern which triggered the move (BOF, TST, BPB etc)

5. Mark where you could have entered with the least risk. With a minimum RR of 1:1

6. Decide on your high probability patterns and high probability locations

Do it at least on 100 charts. The more the better.

Now go live with Mini Nifty. Stick to your locations and patterns. When in doubt stay out. Don’t chase. Maintain strict discipline. Slow and steady will win the race.

Don’t worry if you cannot invent You can always do Reverse Engineering

Tuesday, 6 October 2015

06 Oct 2015, Tuesday

Prices opened Full Gap Up on the day and initial Bias was UP. Took first trade Long in the direction of Bias but the Location was not an DP. Closed the trade with a small loss of 7 Points (including Brokrage). Prices Re-tested the PDH and RN DP. It was a Good setup to enter short but did not enter as I was already in long position.

Prices approached to the MSP-8125 and the most of the bars were overlapping bars which shows a range in market. Entered Long on Second BOF of Day Low and MSP-8125. Prices moved up and after breaking the MSP prices came down rapidly and hit my SL.

By this time, I noticed that prices are moving in a descending channel and decided to buy on BOF of Channel Low Line. BOF of Channel Low happened and Entered Long. Covered the Position on FTA.

05 Oct 2015, Monday

On the day I traded with the On-Going Analysis and Trading Sheet Process and as we can see from charts that I took the first trade long on BPB of RN and covered it once the BO candle closes. Thereafter I went for some work and came back near about in noon. Till than I was following my set processes and when I re-joined then I left the on-going analysis apart (refer the On-Going Analysis Sheet of the Day) and did not wish to log into that and took three counter trend trades (Short) one after another and bring my account from profitable to loss account.

Lesson Learnt -

1. Follow the Process as it controls the urge to enter immediately without any thought which is a bad habit in me and must be controlled. This is the only procedure by which it can be controlled.

2. Always trade in the direction of Current Market Bias.

Sunday, 4 October 2015

15 Sep 2015 & 30 Sep 2015 - Method of Improving Discipline During Trading

The above charts are showing trading done by me on 15th Sep and 30th Sep 2015. I have taken a long time to accept the reality of the act done by me which is quite clearly visible on the above charts. I badly hit my accounts and my confidence to trade too. It took me a long to analyze my mistakes and pen down those mistakes and then to find a way to check these mistakes. The details are as below:

15th Sep 2015 - Mistakes

(a) Lack of Discipline

(b) Entering into Trades one after another seems like doing revenge trading and trying to chasing the market instead trading

(c) Lack of Trade Management

(d) Money Management is Totally Missing

30th Sep 2015 - Mistakes include the above and below line

(a) Trading against the market Bias.

I recognize the above mistakes needs to be corrected and after various + and - processes, finally I developed a process which automatically prevents me for doing these mistakes. The only requirement is to update the data in the excel file and it will automatically calculate the data and I need to analyse and refer this data on regular basis during the session . The snap shot of the process is as follows:

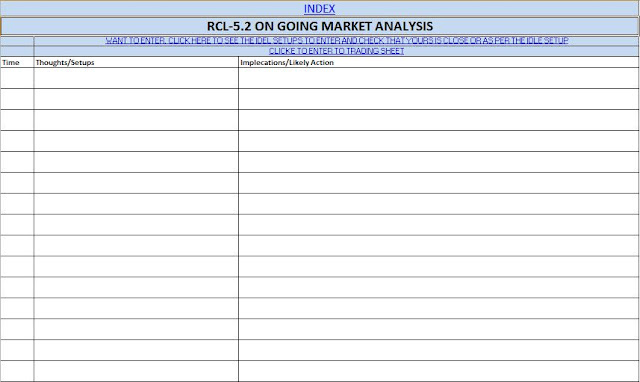

On-Going Analysis:

The sheet is self explanatory and inspired from the chart technical.blog.com. It will be used to log the on-going analysis during trading sessions so that I can concentrate on the well determined DP and I should not chase market one after another trade.

Trading Sheet:

It will be used to log the trades to know and get updated about the current account status so that I can judge and take a effective decision on upcoming trading session. It also includes a "Trading Feasibility Check" Module which gives me a correct idea that if my SL get executed then what will be my account status and on the basis of that I can make the effective decision.

I am sure that if I will follow the process then I will skip the above mistakes automatically.

Happy Trading :)

Tuesday, 29 September 2015

29 Sep 2015, Tuesday

Market opens full gap down and trading in a tight range of 7720-7740. BO of IRL occurs at 1133 and prices went down till 7708. Thereafter prices pull back to the BO level. Went Short at Pull back as shown in chart Although the BRN-7700 was just near. Exited on SL execution.

No other trades taken today due to high volatility. Due to high volatility, my SL will be wider and any loss due to SL execution will impact badly to my account.

Monday, 14 September 2015

14 Sep 2015

Market opens within previous days range and just near to PDC(7823) . First candle was a spin candle with high volume of above one lakh which shows a high degree of indecision in the trader. Next candle was a bearish low range closed candle and indicates the BOF of PDC. Prices moved in downtrend without a pullback to PDC and did not give opportunity to enter short at weak pullback to PDC. Prices moved to 7765 and made a IRL at 7765 at Point B. Prices bounced back to test the BRN - 7800 at point C. BO Occurs at BRN and there was an opportunity to enter on pullback of BOF of BRN which I did not took as I was away from screen. Prices again went down to IRL-7765. Prices failed to go lower than the IRL and FTC signal occurs. Long Entry opportunity occurs when prices went above candle E. I did not took the trade as still I was not on screen. Prices went till Point F and did not touch the BRN-7800. Prices again went down and stopped at Point E and resisted to go beyond the point E. This gave me a confidence that bulls are resisting the prices to go down beyond the point E. I entered at 7791 when prices went above point F and was expecting a BO of BRN-7800. Although the entry was late as my SL was below point D i.e. 7765 which was a very wide SL and if prices would have come down then my accounts were in big red. Prices make a good move upside thereafter and a strong up-move occurs in terms of BO of BRN. My Target was the point A (IRH-7830. I exited trade at 7833 when spin candle with big tails appears which shows the weakness in the up-move. I left the screen thereafter as I will have to move for some urgent work.

Happy Trading!

Thursday, 3 September 2015

05 Aug 2015

Market opened within Previous day range near to PDC. First Candle Tried to close the Opening Gap and Closed near its high which shows Bullish Sentiment. Traders tried BO of BRN 7800 at candle A with high volume, but no follow through in the next candle and the volume of next candle was also low. Traders once again tried to BO BRN 7800 at candle B and prices succeeded to close above BRN with high volume and prices make a IRH.

Prices then entered in a range and most of the candles were overlapping. I could see the pattern Absorption as mentioned in the Structure and Pattern Book. Entered on the second FTC. Target was PDL whereas prices bounced back from previous swing low. Covered just below BRN

Price then BO on BRN 7800. Entered Long at weak pullback test just after the BO candle with low volume. Covered the Position when a spin candle with long tails appear after a strong bullish candle which appears a great indecision among the traders for this price level.

Monday, 31 August 2015

Mis-Conception by the Stock Market Guru Quote "Warren Buffet"

Recently i have read a article written in Economics Times which quotes the lines of Warren Buffet " Rule No 1 is never lose money, Rule No 2 is never forget Rule No 1". With Due regard to his success as an investor in stock market, i disagree to these quotes a little as an Technical Analystic and Discreationary Trader. As every body knows that the stock market is a bussiness of Probability and it can never happen that you always choose the high probability trades and even if you choose always high probability trades then also sometimes they turn against your choosen direction and you are forced to exit. In my view, Loses are bound to happen in stock market and you are going to loose money in these loses. Only thing is that you can recover these loses by limiting your loses and by increasing your profits more than your losses.

Link to the article:

http://economictimes.indiatimes.com/markets/stocks/news/do-not-forget-warren-buffetts-2-stock-investment-rules-top-10-picks-to-bet-on/articleshow/48742320.cms

Happy Trading Ahead!

Link to the article:

http://economictimes.indiatimes.com/markets/stocks/news/do-not-forget-warren-buffetts-2-stock-investment-rules-top-10-picks-to-bet-on/articleshow/48742320.cms

Happy Trading Ahead!

Saturday, 29 August 2015

Preparation Time

Just Preparing myself for the real battle in the battlefield. Getting Prepared in all aspects which i need to fight during my trading session live.

Hoping for a Good Start. I will be starting my trading with one Lot. My Stratgy will be as below:

(a) I will be trtading with one lot only.

(b) Will be Trading on the Fixed DP Points and Dynamic DP Points as well.

(c) My Target will be to gain 20 points initially.

(d) I will always be entering in the Trade with pre-decided Stop Loss.

(e) My Days Exit Point will be 20 Points Loss. Once 20 Point Loss is booked, i will be exiting the day for Trading and will only be watching the market silently.

(f) Continous 2 day loss will be my week stay time. It means if i will book 20 points loss continously 2 days, i will exit the trading for the week and will re-assess my strategy.

(g) I Have a pre-defined checklist made and customized as per my local requirement which i will be following and will also make the required changed in the checklist if required.

(h) i will be trading on dual screen setup

on screen 1 - 3 minute chart will be there which will be my trading time frame.

on screen 2 - 1 minute chart will be there which will be my entry and exit chart. Also the trading terminal will be there on my secon screen.

Best Of Luck and Happy Trading!

Hoping for a Good Start. I will be starting my trading with one Lot. My Stratgy will be as below:

(a) I will be trtading with one lot only.

(b) Will be Trading on the Fixed DP Points and Dynamic DP Points as well.

(c) My Target will be to gain 20 points initially.

(d) I will always be entering in the Trade with pre-decided Stop Loss.

(e) My Days Exit Point will be 20 Points Loss. Once 20 Point Loss is booked, i will be exiting the day for Trading and will only be watching the market silently.

(f) Continous 2 day loss will be my week stay time. It means if i will book 20 points loss continously 2 days, i will exit the trading for the week and will re-assess my strategy.

(g) I Have a pre-defined checklist made and customized as per my local requirement which i will be following and will also make the required changed in the checklist if required.

(h) i will be trading on dual screen setup

on screen 1 - 3 minute chart will be there which will be my trading time frame.

on screen 2 - 1 minute chart will be there which will be my entry and exit chart. Also the trading terminal will be there on my secon screen.

Best Of Luck and Happy Trading!

Saturday, 22 August 2015

21 Aug 2015

MARKET OPENS WITH GAP DOWN ABOUT 100 POINTS. IT INDICATES THE EARISHNESS IN THE MARKET. MARKET TRADED IN THE RANGE FOR QUITE A LONG TIME.

WENT SHORT @ 8273 ON BOF OF DAY HIGH AND FAILED TO CONTINUE THE BO.

KEPT SL @ 8285 ABOVE THE SIGNAL CANDLE (INVERTED HAMMER) HIGH - 8278.

COVERED POSITION @ 8248.WAS EXPECTING SUPPORT AT SWING LOW OF LAST PIVOT POINT (A) AND THE CANDLE.

MISSED THE LONG ON BREAKOUT OF DAY HIGH. AS I WAS EXPECTING THE BOF TO HAPPEN AS PRICES SHOWS BEARISH STRENGTH. WHEREAS BO HAPENS TO BE SUCCESSFUL

Tuesday, 18 August 2015

18 Aug 2015

NIFTY OPENED GAP UP WITHIN THE PREVIOUS DAY RANGE. THERE WERE THREE LEVELS WHICH ARE OF INTREST JUST AFTER OPENING.

1. PDC

2. PREVIOUS DAY SWING HIGH NEAR TO OPENING

3. PDH

NIFTY MOVEDUP AND MADE A RANGE HIGH @ 8528. THE LEVEL WAS IMMEDIATLY REJECTED BY A BEARISH CANDLE. GENERATED A IRH- DYNAMIC DECISION POINT

NIFTY AGAIN CAME TO TEST THE LEVEL OF IRH AND THE LEVEL WAS REJECTED BY MAKING THE INVERTED HAMMER. ALSO IF WE DO THE VOLUME ANALYSIS THEN AT FIRST REJECTION THE VOLUMES WERE QUITE HIGH AND IF WE SEE VOLUME AT BULLISH LEG JUST BEFORE THE SECOND TEST, THE VOLUMES WERE DIMISHING AND LOW VOLUME WERE SEEN. WHICH INDICATES THE WEAKNESS OF THE BULLISH SIDE. MADE A BOF IN 1st TST OF IRH. SHORT OPPORUNITY AS SHOWN IN FIGURE.

AFTER 1st BOF OF RN-8450, PRICES BOUNCED BACK AND AGAIN CAME BACK TO TEST THE RN-8450. BOF OCCURS AT 1st TEST OF RN-8450. ALTHOUGH IT WAS A LOW PROBABILITY TRADE AS CURRENT BIAS WAS BEARISH. ENTRY SIGNAL OCCURS AT BOF OF RN AT 1st TST.

Starting Day Statement

Hello Everyone

I am a newbee and a silent follower of "http://niftynirvana.blogspot.in" who is following the Decision Point Trading Method since last one year and now i am going to start dummy trading for next few days to check my progress of knowledge in this aspect. I will also be using the amibroker bar replay option to have a dummy trading session and also will be doing dummy trading in real market. I am the follower of SMART TRADER who has guided me on this path and always being there to share his knowledge and experiance. I and am sure many others also will be thankful to him for his precious guidance and knowledge.

I am also writing this blog for the below mentioned reasons:

(a) So that in future i can analyse my progress and if i want to look back in past, the data should be available.

(b) I will be sharing my experiances so that in the progress path, anyone else may able to guide me when i will be wrong.

I am a newbee and a silent follower of "http://niftynirvana.blogspot.in" who is following the Decision Point Trading Method since last one year and now i am going to start dummy trading for next few days to check my progress of knowledge in this aspect. I will also be using the amibroker bar replay option to have a dummy trading session and also will be doing dummy trading in real market. I am the follower of SMART TRADER who has guided me on this path and always being there to share his knowledge and experiance. I and am sure many others also will be thankful to him for his precious guidance and knowledge.

I am also writing this blog for the below mentioned reasons:

(a) So that in future i can analyse my progress and if i want to look back in past, the data should be available.

(b) I will be sharing my experiances so that in the progress path, anyone else may able to guide me when i will be wrong.

HAPPY TRADING DAYS AHEAD!

Subscribe to:

Comments (Atom)